Darshak Shah

Darshak is Evource Co-Founder and an Australian CPA, who has experience of working in over 8 different industries including with employers like NAB & Cancer Council. He has a great eye for process streamlining, improvement, change management, and transitions.

From July 1st 2019 your business needs to be using the ATO’s compulsory new payroll reporting system, Single Touch Payroll (STP).

This new requirement was setup to streamline reporting of employee income and taxes. It means that every single time you run payroll, this information is directly sent to the ATO. Large employers have been using this system for a year now, and the transition concessions for small businesses are almost at their end. If you are a micro employee, with 4 or less employees, you do still have some options. However, if you have more than 5 employees, you must start using STP.

Since the ATO will be receiving payroll information regularly, they will start using this information to prefill activity statements and tax returns, as well as keep employees up to date on Mygov.

If you aren’t yet prepared, then there is really no time to lose. Here’s what you need to know about STP:

1. When To Start

You can start now, but you must have your software set up for STP for your first payroll in the 2020 financial year. This means that the first payrun you do after July 1st 2019 needs to be on STP compliant software.

To keep your information clear and prevent double handling, at this stage it would be advisable to have your STP system ready to go from the first pay period in July 2019.

2. Ensure your software supports Single Touch Payroll

If you are using an external payroll provider you will need to ensure they are up to speed and ready to go with STP requirements.

If you’re managing payroll in house and already using a software provider, such as Xero, MYOB, or Quickbooks, then you should have been seeing notifications from them advising you to get your payroll connected for STP. Now is the time to follow the instructions and get set up.

If you are a small business who has been manually paying your staff, then you will need to upgrade to an STP compliant comprehensive software solution that requires a subscription fee.

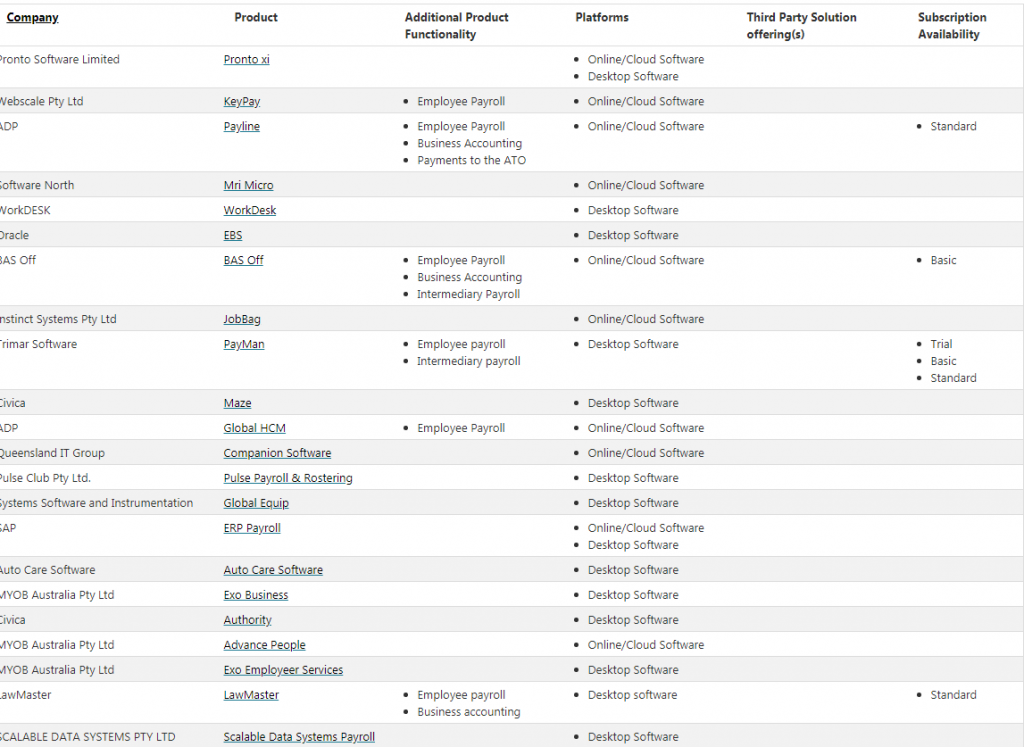

The ATO has compiled a list of all of the STP software providers. You can access this list here.

If you are a micro business (1-4 employees) there are no and low cost options.

You can check the ATO list to see which providers give you free or low cost options. These options include mobile apps, cloud, web, and desktop software. Only options that cost $10 or less a month are included, and there are some free options on the list.

A micro business does also have the option of getting their registered tax or BAS agent to report their STP information quarterly instead. This concession is only available until 30th June 2021.

3. Ensure your payroll staff understand STP and know how to properly record employee entitlements.

Check that all your employee records are up to date with TFNs, correct tax options, and contact details.

Ensure your payroll officer is skilled, and trained for the change. This helps reduce mistakes, and ensures they know how to correct errors when they do occur.

If you have an in-house payroll manager who needs more information, ensure they read and understand the ATO’s comprehensive list of STP reporting guidelines.

4. Ensure the person who will submitting your payroll is authorised to send the reports to the ATO

While business owners and public officers are authorised to send the STP reports, you will need to register anyone else. If you have a payroll officer, or someone who steps in to help you out at times, make sure they are authorised in the payroll software. The software you are using will have the instructions to do this. This registration is done through the software.

5. Check how your software provider will connect to the ATO

Your software provider may connect through a sending service provider (SSP), which means your SSP will set up your ATO connection for you.

If they do not connect to the ATO on your behalf, you will need to contact the ATO (or get your tax agent to contact the ATO) to connect through a software service ID (SSID). To do this you can to contact the ATO on 1300 852 232 or on your ATO Access Manager, if you have this set up.

6. Ensure you have the right contact person set up with the ATO

The ATO will need to have the right contact person listed, to ensure they can contact you if there are any issues. Ensure this is the person who understands your payroll properly and can answer any questions about payroll calculations and setup.

7. Be aware of who and what is included in Single Touch Payroll

Included:

- All ordinary salary and wage payments

- Director or office holder remuneration

- Work related payments to individuals such as return to work, termination, unused leave, parental leave, and Dad and partner pay

Optional:

- Payments to individuals contracted under a voluntary agreement or a labour hire arrangement

- ETP death benefits.

Not Included (payments other than typical wages):

- Alienated PSI

- Payments to foreign residents

- Royalties

Do you make irregular payments or payments that don’t fall under the scope of typical wages? Make sure you check the ATO’s detailed list of payments to ensure you know what is included and what is excluded from STP reporting.

8. Start STP reporting and check your data

When you make your first payment using STP, ensure you check that your software confirms you have successfully submitted your payroll report to the ATO. Follow up on any errors or alerts so that you don’t fall behind on your reporting requirements.

You can also check your ATO Business Portal after 72 hours to ensure the report has come through correctly.

9. Be aware of your end of financial year obligations

You are required to finalise your ATO declaration by the 14th of July. This declaration is a replacement for the summary that you usually lodge with the ATO and it confirms that all of an employee’s payment information has been entered via the STP system.

Since your employee payroll information is going directly to the ATO you typically no longer have to provide PAYGW summaries. Employees can access their information from myGov, or directly with the ATO.

If you have made any payments through the year that are not included in STP, then you will still need to issue annual PAYGW Summaries for these payments.

10. Understand how to fix mistakes

Payroll mistakes can be rectified via a pay event “update” on your STP software, or, if suitable, as an adjustment with the next regular pay.

End of year finalisation report amendments should be made within 14 days of becoming aware of an error. You can let the ATO know amendments are pending by submitting a “FALSE” final indicator on an update event.

11. If you need further clarity, check with the ATO

Refer to the ATO checklist and detailed information, including webinars, for further information and clarification of less common scenarios.

Are You Ready To Go?

If you’re on the ball and just need to tweak a few things, then don’t put it off any longer. July 1st is just around the corner. If you’ve been putting this off, it’s now time to get ready!

It is important to note that in recognition of the transition period, the ATO will not penalise late reporting for the first 12 months of STP use. However, if they issue you written notice that you have failed to report on time, then you are likely to be penalised going forward. Get on top of things now so that you don’t fall behind.

You’ve only got weeks left to get sorted!