Ridhi Shah

Ridhi is an Australian MPA who has done her Diploma in Financial Planning and excels in various financial and accounting services.

Cash flow is, simply put, the amount of cash that comes into your business less the amount of cash that goes out of the business. Don’t confuse this with profits, or withdrawing on debt to make ends meet. Do utilise a sound understanding of cash flow to make solid business decisions.

Positive Cash Flow And Negative Cash Flow

When your business is cash flow positive you have more money coming in than going out. This means you have a cash surplus after covering your financial obligations. Incoming cash comes from your business sales. Additional cash inflow can come from the sale of business assets. Cash outflows are the amounts you pay for expenses, purchase of assets, investments, and debt repayments.

On the other side, a business that is cash flow negative has more cash going out than coming in. This means the business is unable to meet their financial obligations, or they are drawing on debt to do so. While a business may expect to go through a period of negative cash flow during launch or investment stages, it is not a position that can be maintained long term.

Operational Cash Flow

Your operational cash flow is simply the cash coming in from sales, less the cash going out to pay for expenses. If you aren’t generating a positive operational cash flow then this is a big sign that your business is in trouble. You need the surplus cash from operations to invest in further business assets, repay debts, and pay out the owner’s profits. When you are generating a positive cash flow then you’re hitting the mark with bringing in enough money from your sales.

Cash Flow And Your Bank Balance

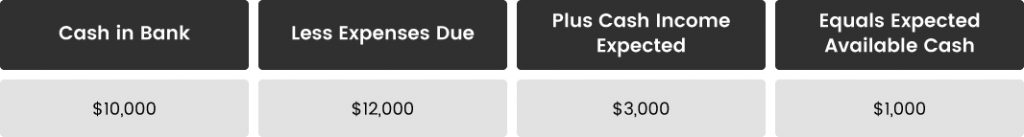

It can be tempting to just look at your bank balance to see where your cash is at. However, this is a mistake. Your bank balance will only tell you how much money you have available to you at that point in time. It doesn’t highlight how many obligations you have to pay and whether you have the money on hand to cover them all. This is why it is essential to understand your projected cash flows and upcoming obligations, not just your bank balance on hand. With a solid understanding on hand, you can continue to make smart business decisions.

In simplistic terms you need to have a solid grasp on where your available cash is on both a short and long term basis:

Cash Flow Projection

While understanding what your cash flow is may sound simple, what really matters is understanding the business’ cash flow projection. This is basically a fancy term for your cash budget. You track your expected cash inflows and cash outflows so that you can see your expected cash position at any point. When the projections show ongoing negative cash flow the business needs to make a decision on whether this is an issue that can be fixed, or something more serious. A healthy business with a positive cash flow position is then able to make decisions on what to do with the surplus funds.

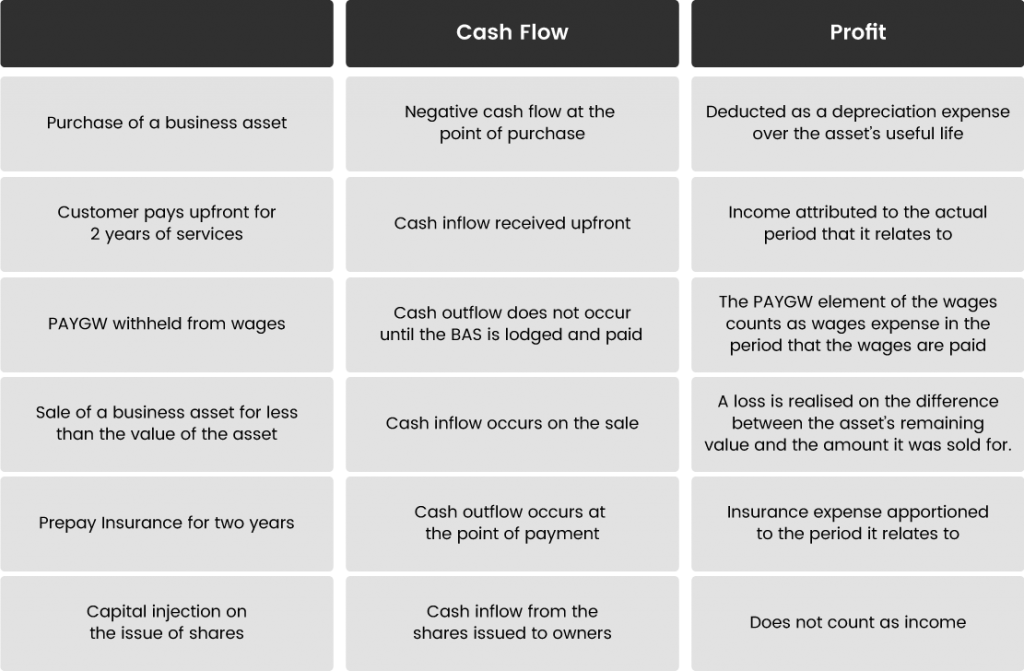

Cash Flow Vs Profits

This can be a confusing point since there are several reasons that profits and cash flow may not align. The following table highlights some differences:

Cash Accounting Vs Accruals

As you can see from the example above, some of the differences between cash flow and profits are timing differences. This is essentially the difference between cash accounting and accruals. Cash accounting counts income when it is received and expenses when they are paid. Accrual accounting counts income when it is earned and expenses when they are incurred, regardless of whether they are paid or not.

Liquidity Vs Insolvency

When there is not enough cash to cover the immediate financial needs of the business it is suffering from a liquidity issue. This is a temporary situation that can be remedied by going into debt to cover the required outflow. This may include negotiating longer repayment terms with creditors, drawing out a loan, or the business owner covering the costs out of their own pocket.

Insolvency is when a liquidity issue is ongoing or too big to be covered by temporary means. It means there is no foreseeable way of covering the costs and turning the business around so that it becomes cash flow positive. A business that is unable to meet their debts when and as they fall due is considered to be insolvent and cannot keep trading.

Cash Flow

Work on ensuring that your incoming cash will consistently cover your outgoing cash obligations and you’ve got it covered. Don’t make the mistake of seeing cash income from drawing down on debts as positive cash flow. This is a temporary loan that will need to be repaid, with interest, meaning that there is a negative cash flow effect overall. Don’t confuse profitability with cash flow. If you have a mountain of debtors who aren’t paying you or have used up all your cash to invest in business assets, then your ability to pay your financial obligations can be very different to the picture that your profit and loss statement paints.

Take charge of your business by ensuring that you understand cash flow and what the cash flow of your business is. By utilising available cash to further grow your business you have the power to continue to improve that cash flow!